“Riding the Wave of Opportunity: How Blue Bonds are Accelerating Sustainable Ocean Businesses.”

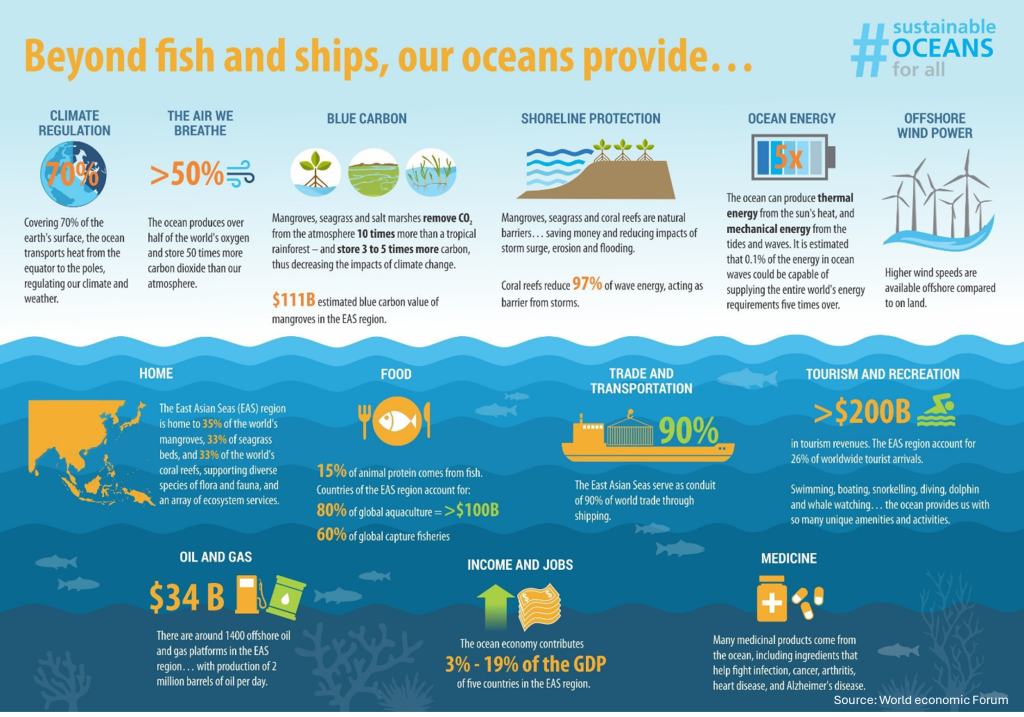

Seventy-one percent of the Earth’s surface is ocean, and billions of people depend on the oceans for their livelihoods. Maritime transport remains an essential part of international trade as over 90% is carried by the seas, according to the United Nation’s (UN) International Maritime Organization.

The renewed attention on the ocean in recent years is reflected in the UN Sustainable Development Goals, as goal number 14 aims to “conserve and sustainably use the ocean, seas and marine resources for sustainable development”.

The blue economy is of growing importance and gaining momentum amongst policymakers across the world. This is not surprising as the ocean is a significant wealth generator estimated at an annual value of $1.5 trillion per year, making it the world’s seventh largest economy.

What are Blue Bonds?

Blue bonds are debt securities issued by governments, development banks, or corporations to raise capital specifically for funding ocean-related environmental projects. These projects often include marine conservation, sustainable fisheries, pollution reduction, and the development of marine protected areas. Like green bonds, which focus on environmental projects on land, blue bonds are earmarked for initiatives that preserve and sustain the world’s oceans and marine resources.

The Significance of Blue Bonds

The oceans cover more than 70% of the Earth’s surface and play a crucial role in regulating the global climate system, supporting biodiversity, and providing livelihoods for millions of people around the world. Despite their importance, oceans are facing unprecedented threats from overfishing, pollution, and climate change. Blue bonds emerge as a critical tool in mobilizing the financial resources needed to address these challenges, promote sustainable use of ocean resources, and foster a blue economy.

How Do Blue Bonds Work?

Blue bonds follow a similar framework to other sustainability bonds, with a few specificities:

- Issuance and Investment: An entity issues a blue bond to investors, promising to repay the principal along with interest over a certain period. The funds raised are dedicated to financing eligible marine and ocean-based projects. 2

- Project Selection: Projects are carefully selected based on their potential environmental impact, alignment with sustainable development goals, and contribution to the blue economy. 3

- Reporting and Transparency: Issuers of blue bonds commit to transparency and regular reporting on how the funds are used and the environmental outcomes of the projects financed, ensuring accountability and effectiveness.

Types of projects supported by the blue bond market.

The most common types of projects supported or expected to be supported by the blue bonds as per ADB are as follows:

- Coastal climate adaptation and resilience

- Marine ecosystem management, conservation, and restoration

- Sustainable coastal and marine tourism

- Sustainable marine value chains

- Sustainable marine fisheries management

- Sustainable aquaculture operations

- Sustainable downstream operations, including transparency and traceability across supply chains.

5.Marine renewable energy

6.Marine pollution

- Wastewater management

- Solid waste management

- Resource efficiency and circular economy

- Non-point source pollution

7. Sustainable ports

8. Sustainable marine transportation

Notable Examples of Blue Bonds

- The Seychelles Blue Bond: In 2018, the Republic of Seychelles issued the world’s first sovereign blue bond, raising $15 million to support sustainable marine and fisheries projects. This groundbreaking initiative paved the way for other nations to explore blue financing options.

- The Nordic Investment Bank (NIB) Blue Bond: The NIB issued a blue bond in 2019 to finance projects related to water management and protection in the Nordic and Baltic regions, showcasing how regional banks can contribute to marine conservation.

The Future of Blue Bonds

As awareness of the critical state of the world’s oceans grows, so does interest in blue bonds. These financial instruments offer a promising pathway to support the transition towards a sustainable blue economy, balancing economic growth with the need to preserve marine ecosystems. For investors, blue bonds represent an opportunity to contribute to global conservation efforts while potentially securing financial returns.

Conclusion

Blue bonds stand at the intersection of finance and sustainability, offering a novel approach to funding the preservation and sustainable use of the world’s oceans. As the market for these instruments grows, they could play a pivotal role in mobilizing resources for marine conservation, supporting biodiversity, and fostering sustainable livelihoods. For governments, corporations, and investors alike, blue bonds offer a compelling opportunity to make a tangible impact on the health of our planet’s most vital ecosystem.